Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

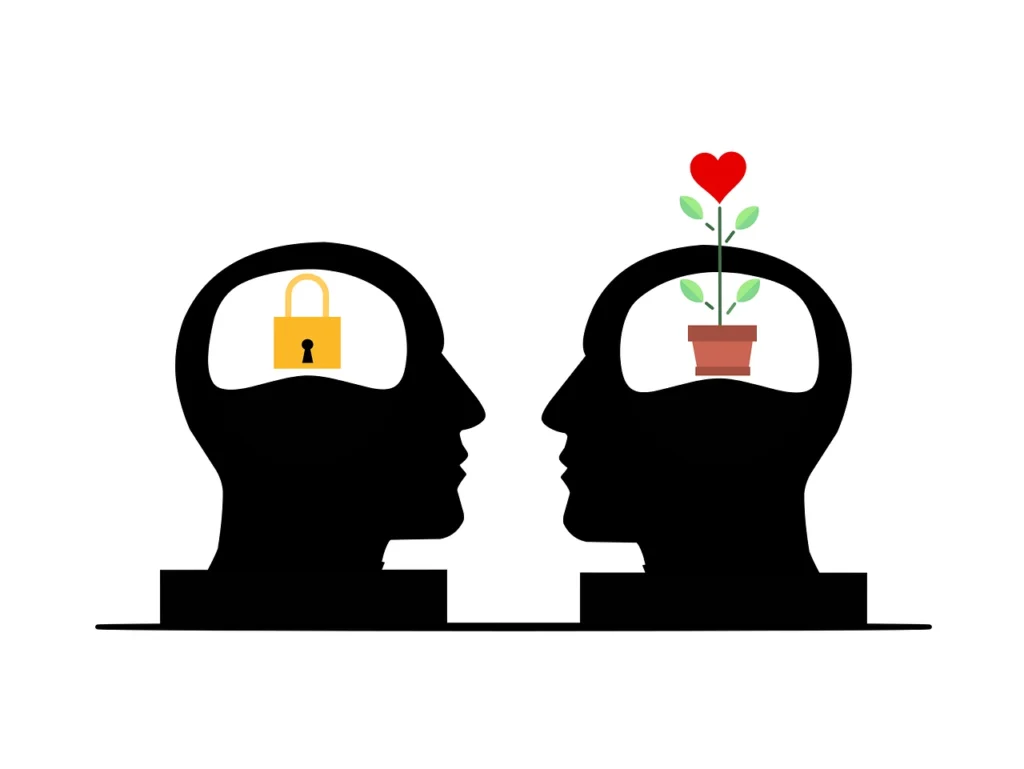

Overcome money blocks by recognizing hidden psychological barriers that prevent financial success. These mental obstacles, often operating subconsciously, shape your beliefs, decisions, and overall relationship with money. No matter how hard you work or save, if you have money blocks, financial success may remain elusive.

In this comprehensive guide, you’ll learn how to identify these blocks and discover actionable strategies to break through them, unlocking your full financial potential.

Money blocks are internalized limiting beliefs or attitudes about money that sabotage your financial growth. They can stem from childhood experiences, cultural influences, or personal traumas. These blocks manifest in different ways, including procrastination with financial planning, fear of wealth, or impulsive spending.

Common Money Blocks Include:

These beliefs don’t just limit your earning potential, they also erode your financial confidence and long-term stability.

The effects of money blocks go beyond your wallet. They can influence your mental health, relationships, and career growth. For example:

Understanding the ripple effects of these blocks highlights why addressing them is so crucial.

Here are some indicators that you may be struggling with money blocks:

Do you procrastinate on budgeting, paying bills, or filing taxes? Avoidance can be a way to escape feelings of overwhelm or inadequacy.

If you constantly worry there’s “never enough,” you may unconsciously sabotage opportunities for financial growth.

While it sounds counterintuitive, many people fear that earning more money will alienate them from their friends, increase their responsibilities, or attract unwanted attention.

Whether it’s asking for a raise or setting fair prices for your business, undervaluing yourself reflects deeper insecurities.

This might include overspending, under-saving, or neglecting to invest in personal or professional growth.

Self-awareness is the first step in overcoming money blocks. Here’s how to uncover the hidden beliefs holding you back:

Reflect on your earliest interactions with money. Were you exposed to phrases such as “Money doesn’t grow on trees” or “We can’t afford that”? These messages often leave a lasting impact on your financial mindset.

Take a close look at your spending, saving, and investing habits. Are there recurring behaviors that suggest fear, guilt, or avoidance?

Societal norms and peer pressure can also contribute to money blocks. For instance, you might feel guilty about earning more than others in your social circle.

Once you’ve identified your money blocks, the next step is taking intentional action to overcome them. Here’s how:

Financial literacy is key to overcoming fear and uncertainty. Resources like books, podcasts, and online courses can help you understand budgeting, investing, and wealth-building.

Set clear, actionable financial goals and break them into manageable steps. For example:

Practicing gratitude shifts your focus from lack to abundance, while acts of generosity reinforce the idea that money can be a positive force for change.

Sometimes overcoming money blocks requires professional help. Financial therapists or coaches can guide you in identifying emotional and psychological barriers you may not be aware of. According to the Financial Therapy Association (financialtherapyassociation), understanding your emotional relationship with money is crucial to overcoming these challenges and achieving financial well-being. A therapist can help you address deep-seated beliefs and reshape your mindset toward wealth.

Beyond eliminating blocks, cultivating a proactive mindset is essential for long-term success. Here are some strategies to build a healthier relationship with money:

Believe in limitless possibilities for wealth and success. Remind yourself that another person’s success doesn’t diminish your own opportunities.

Every step toward your financial goals is worth celebrating, whether it’s saving $50 or paying off a small debt. These victories keep you motivated.

Follow financial experts, join supportive communities, and connect with like-minded individuals who inspire you to grow.

Remember that your value as a person isn’t determined by the size of your bank account. This mindset helps you approach money with a healthier perspective.

Listening to the success stories of others can inspire and motivate you. Here are a few examples of people who have successfully overcome their money blocks:

Money blocks may feel insurmountable, but with self-awareness and consistent effort, you can overcome money blocks and break free from their grip. By identifying your limiting beliefs, embracing a growth-oriented mindset, and taking actionable steps, you’ll pave the way for lasting financial success.

Take charge of your financial future today. Reflect on your habits, rewrite your money story, and move confidently toward abundance and stability. As you continue to overcome money blocks, you’ll unlock your full financial potential.